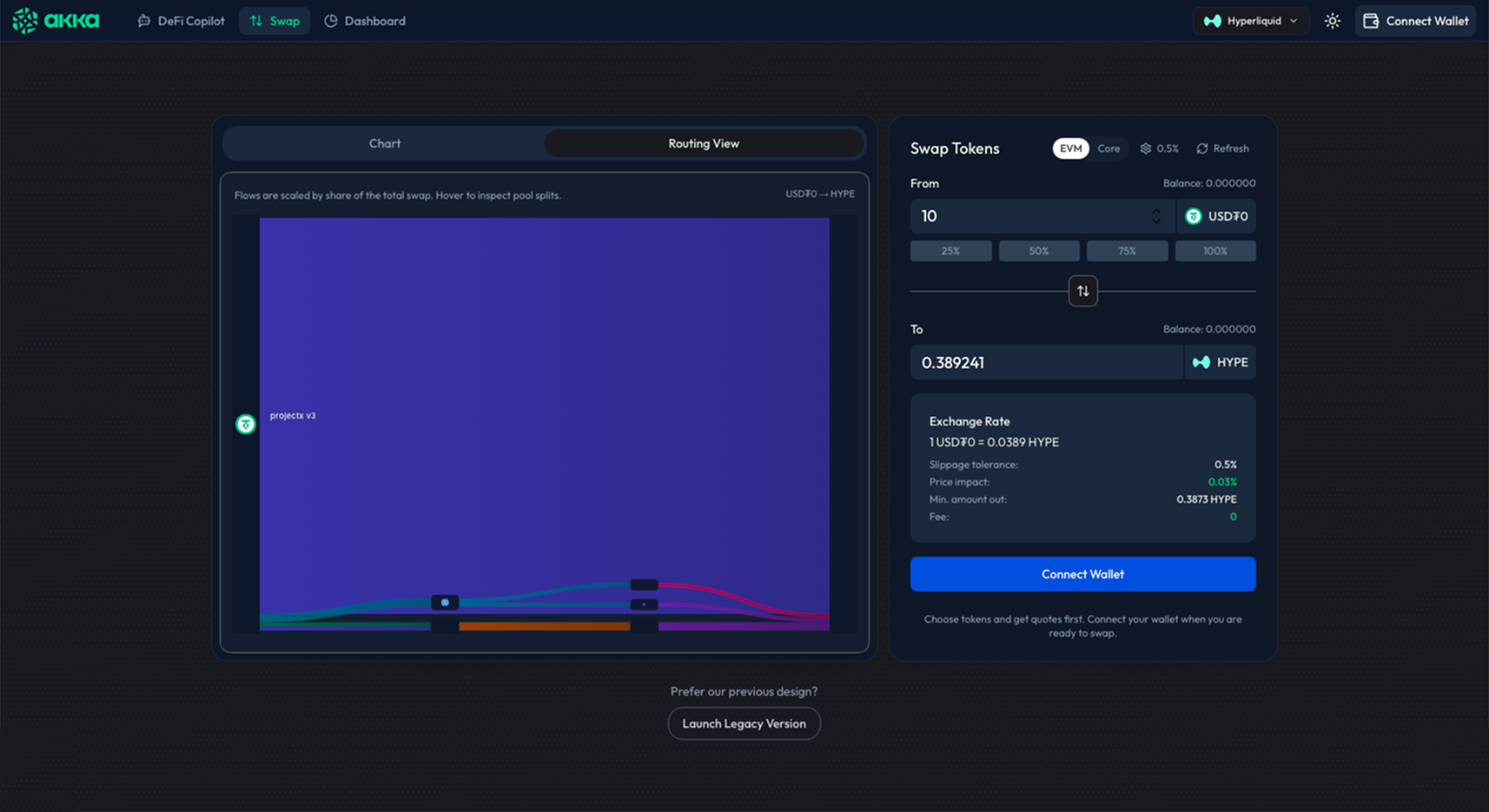

Execution Infrastructure

for DeFi Liquidity

Accurate, reliable execution with best available rates in real market conditions.Akka turns fragmented liquidity into accurate, reliable execution, delivering the best available rates in real market conditions.

Built for platforms and serious traders.Built for platforms and serious traders who care about real outcomes, not just quotes.

What Akka Does

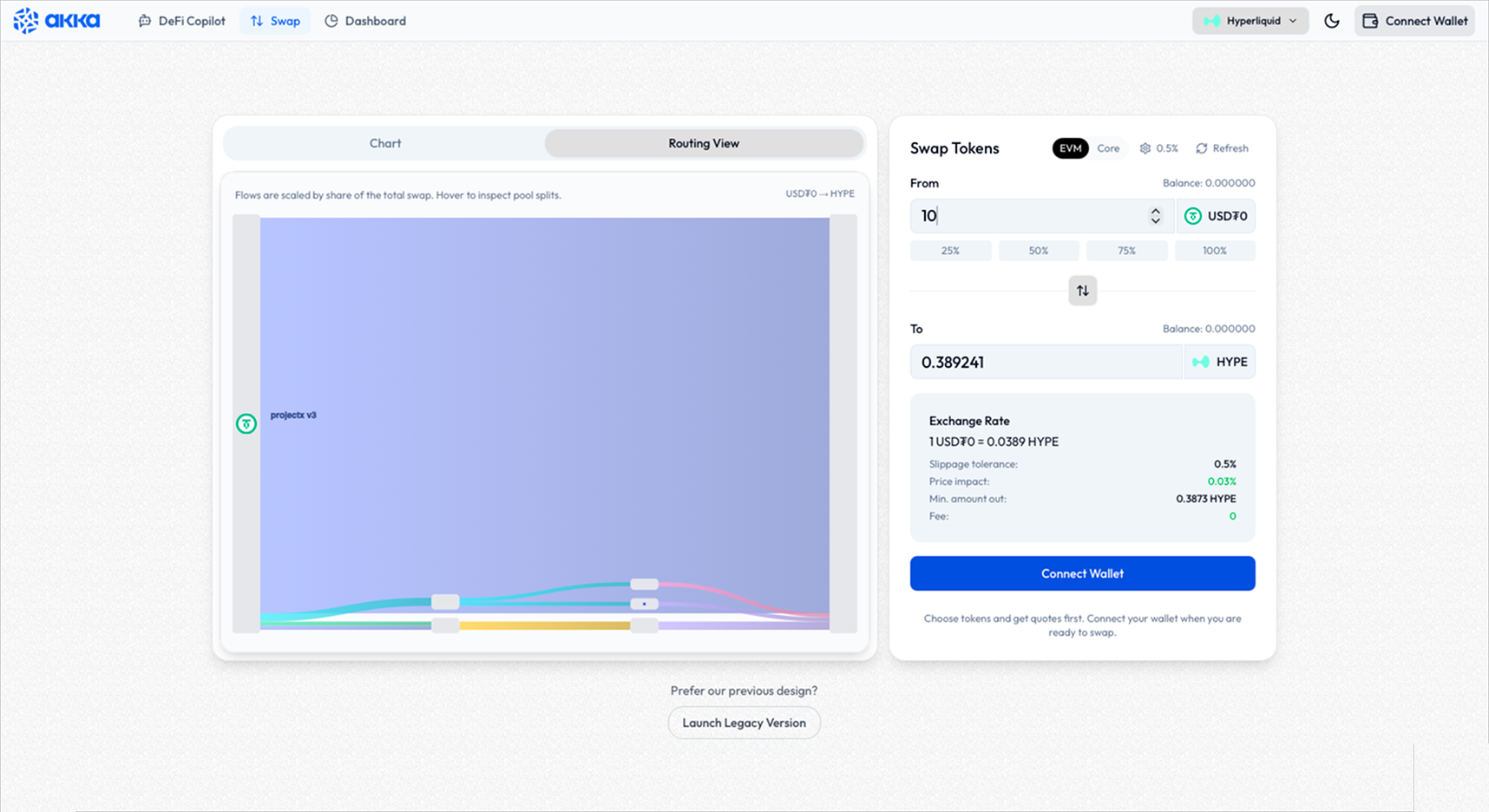

Akka aggregates fragmented on-chain liquidity and routes trades through execution-optimized paths to maximize fill quality, minimize slippage, and deliver reliable performance when it matters most.

Unified liquidity routing across multiple venues

Access deeper liquidity and better fills by routing your trade across multiple venues automatically.

Execution-first and accuracy-focused path selection

Get trades executed the way they're quoted, with routes chosen for real outcomes, not just prices.

Designed for volatile and high-stress conditions

Trade with confidence during fast markets, congestion, and sudden volatility without execution surprises.

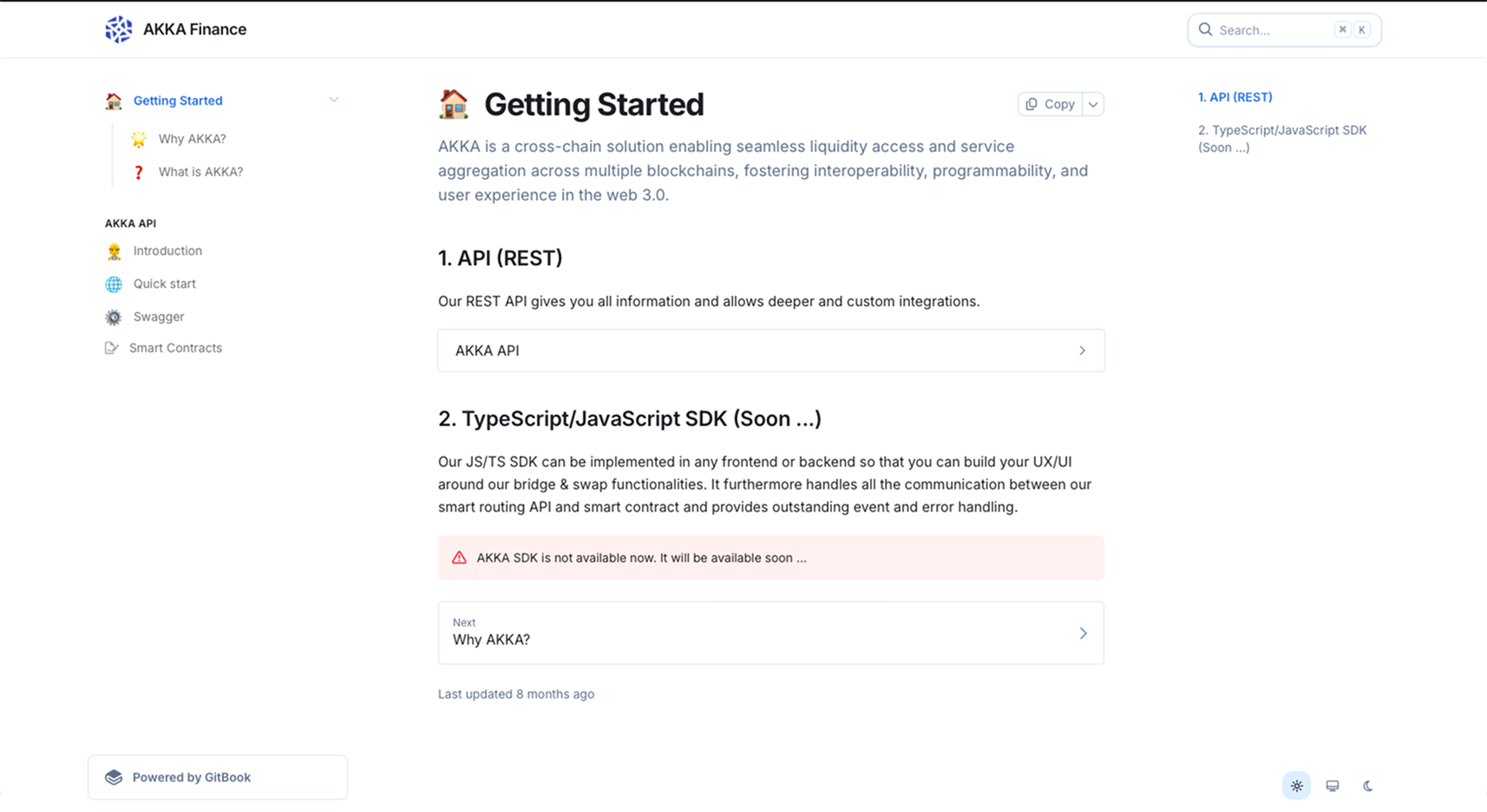

For Platforms & Developers

Akka provides a production-ready execution layer for wallets, trading platforms, and DeFi applications. Integrate once and access optimized liquidity routing without building and maintaining complex infrastructure.

Single integration for deep liquidity access

Lower engineering and maintenance overhead

Improved execution, higher user retention and volume

Ready to supercharge your platform?

Get started in minutes with our comprehensive API documentation and SDKs.

For Serious Traders

Akka is built for execution-sensitive traders who care about how orders fill, not just quoted prices. Ideal for those operating size, speed, or automation strategies.

Reduced slippage on large or fast trades

Higher execution success during volatility

Cleaner routing when default paths fail

See the difference for yourself

Compare execution quality in real-time. No signup required.

Built for Execution

Not Just Price Discovery

Many systems optimize for quoted prices. Akka optimizes for outcomes.

Our routing logic prioritizes fill reliability, slippage control, and deterministic execution across fragmented liquidity.

Execution-First Routing

Routes trades based on likelihood of full execution and slippage control, not just quoted prices or shortest paths.

Failure-Aware Execution Logic

Anticipates fragile routes and avoids brittle paths, reducing failed or partial transactions during volatility.

Liquidity Intelligence Layer

Evaluates liquidity quality and depth behavior under size, enabling more consistent execution across market conditions.

Trusted Execution at Scale

Akka already powers meaningful execution where reliability matters.

$200M+

Volume Routed

1M+

Transactions Executed

10,000+

Active Wallets

Live

Across Multiple Chains

Execution Matters More Than Quotes

If your platform or strategy depends on reliable execution, Akka belongs in your stack.